Road Map for Trading Success

Why do many traders lose money in markets?

Trading in financial markets is Zero Sum Probabilistic Mind Game. As it is a zero sum game, one player’s loss is another player’s gain. Statistics suggests that about 90% of traders lose money in markets while only fewer percentages of traders make money consistently. Next key point is that trading is a probabilistic mind game. That means, there is no certain outcome in trading and as markets are driven by mass psychology, the trader’s nerves/emotions are tested by its movements constantly. Many people think that successful traders always win but in reality, it is not the case. Successful traders make more gains than losses consistently. Traders are always exposed to ‘uncertainty’. To handle the uncertainty, traders should accept the uncertainty and develop a disciplined, focused and relaxed state of mind. But, most traders complicate the situation by facing the uncertainty and market’s wild gyrations with emotions (mainly fear, greed and hope) and make trading mistakes regularly. In essence, traders must have a definite edge over others to win the complex trading game. The edge may be a disciplined mind set with flexibility, strict risk/money management, sound trading system/method or combination of these key criteria.

Most of the traders do not equip themselves (invest time and effort) with these key requirements and look for easy money. They try their luck with untested methods, tips, no risk control and/or emotional/impulsive trading. Eventually, they end up with losses. If anybody thinks that trading is an easy way to make money, he/she must re-evaluate their idea before start trading.

The Ingredients of Successful Trading

In order to achieve consistent success in trading, traders must develop their skills in three major areas

(i) Winning Psychology

(ii) Money Management

(iii) Sound Trading System

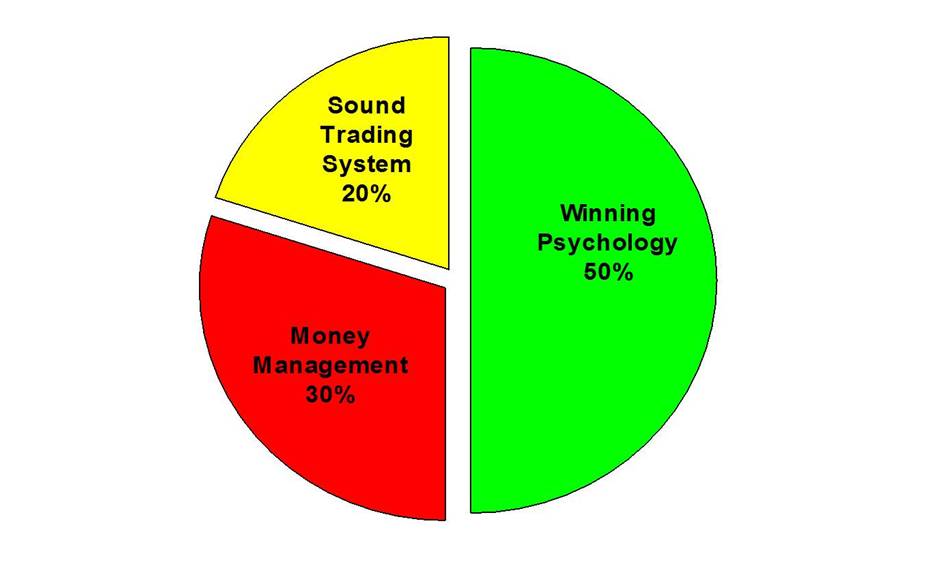

Figure 1 Ingredients of Successful Trading

We prefer to give more importance to winning psychology, then money management, followed by trading systems as shown in Figure 1. When traders develop their expertise in these three aspects, they should be able to make money from markets consistently. Let us discuss in detail about each of these aspects in following sections.

Winning Psychology (TRADER’S MIND)

To attain winning psychology, traders need to overcome three major destructive emotions; Fear, Greed and Hope. FEAR is the major source of many errors in the markets and it is the most destructive mental force for a trader. Fear is a complex emotion taking many forms such as worry, fright, alarm and panic. When fear is given free rein, it typically combines with other negative emotion such as hatred, hostility, anger and revenge, thereby attaining even greater destructive power. Fear is basically caused by ego and money. Primary trading fears are being wrong, losing money, missing out a trade and leaving money on the table. The solution for trading without fear is learning to admit that losing is part of the game and ACCEPT THE RISK. Traders must accept the risk consciously as well as subconsciously. The trading rule ‘Never Trade More than You Can Reasonably Afford to Lose’ makes a lot of sense in handling fear. Only ‘Risk Capital’ should be used for trading. If you trade with scared money, possibility of losing any portion of it, will create a lot of stress & fear and impact your trading psychology and decision making.

The next destructive emotion, GREED results from the combination of overconfidence (euphoria followed by success) and a desire to achieve profitable results in the shortest amount of time. Though certain extent of greed is necessary to succeed in trading, traders become reckless and sabotage themselves when greed exceeds the limit. In this age of leveraged markets, it is common for people, to be tempted and carried away by the lure of quick rich dreams, start overtrading beyond their risk tolerance/limit. People do not understand and take into consideration that leverage can work both ways; unlimited potential for profit as well as loss. When this emotion takes over, a trader will usually throw caution to the wind. Also, after a series of wins, traders become overconfident and plunge into more risk taking with careless decision making, which always leads to disaster. Successful traders often make a deliberate effort to stay out of the markets after they have experienced a profitable campaign. Greed is created when one thinks only about rewards. When you learn to analyse the markets with risk – reward potential always, you won’t be carried away by destructive greed.

HOPE could be a positive emotion in real life but hope will ruin traders as it is just a wishful thinking and many times it turns a small bearable loss into account/career damaging serious loss. Hope is one of the greatest obstacles to clear thinking and maintenance of objectivity in trading. It is prudent to follow the popular trading rules ‘Never Trade Based on Hope & When in Doubt, Stay Out’. Whenever you can identify hope as the primary justification for holding a position, it is advisable to close it out immediately. Many times, traders will get clarity about market trends after closing out their losing position. Closing losing positions will free traders from biases and reinstate objectivity in market analysis.

While overcoming three major destructive emotions, traders must learn to think in probabilities to succeed in the game as trading is a probability game. Traders have to be flexible in their expectations so that they can adapt to the ever changing market conditions quickly. They need to develop some more key positive characters to win consistently in markets. They are;

(i) Passion for markets

(ii) Confidence and Discipline

(iii) Objectivity and Flexibility

(iv) Self Reliant and Take full Responsibility for trading results &

(v) Calm and focus on present realities.

One of the easiest ways to maintain objectivity and discipline is to learn think in terms of Risk - Reward. This brings the next important pillar of successful trading ‘Money Management’.

Money Management Principles

Failure to adhere to sound money management principles led to the end of many people’s career in trading business. Adopting sound money management techniques can make huge difference for your bottom line.

Learn to take small losses to stay in the business

Do trade with RISK CAPITAL (Money that you afford to lose) and don’t trade with borrowed money. Learning to take small losses is the first/best lesson to stay and win the trading business. Incurring small losses should be viewed as paying insurance to stay in the business. Otherwise, one large loss may potentially wipe-out your trading account and end your career in markets. When your loss gets larger, the amount of return to be generated to breakeven multiplies (Refer to attached trade equity performance table in the event of loss). So it is advisable to keep loss in a trade as a smaller percentage of equity.

Loss in Trade Equity | Return to be generated to bring back the equity to Breakeven Level |

20% | 25% |

40% | 67% |

50% | 100% |

75% | 300% |

90% | 900% |

Figure 2 Trade equity performance table in the event of loss

The “2% Per Trade Risk Rule”

We believe in 2% per trade risk rule for all our trades. At any point of trade, traders should not risk more than 2% of their equity (Aggressive traders may go for 4%). In simple words, a conservative trader can last for 50 consecutive losses while aggressive trader affords 25 consecutive losses.

Example: The “2% Risk Rule”

Trading Account Size: $ 5,000

2% of $ 5,000 (Trading Account Size) = $ 100

On any given trade, you should risk no more than $100 which includes commission and slippage. If you trade in EURUSD currency with a 50 pips stop, you should be able to trade only 2 Mini (10K) contracts only (not including commission and slippage).

If you do not add-on to a current position, but your stop moves up along with your trade, then you are locking in profits. When you lock in profits with a new trailing stop, your risk on this profitable trade is no longer 2%. Thus, you may now place additional trades. So, Additional positions are only possible when your initial trade breaks even.

A day trader should not lose more than 6% of equity in a day. If he/she hits 6% loss, he should stop trading for the day.

When a trader loses 30-50% of capital, he/she should stop trading and re-evaluate the trading strategies and tests the revised strategies in Demo account. When traders get back the confidence on their system and money management strategies, they can start trading again.

Risk – Reward Ratio

Risk to Reward Ratio, the relative size of your profits compared with your losses is another key money management tool. It is advisable to have a 2:1 (or better) risk to reward relationship when first putting on a trade. However, this may be pretty difficult to find. It would be more realistic to find (or create) a trading methodology that has a 1:1 risk to reward relationship; then once you factor in your ‘trade management’ to the trades it comes out to a 2:1+ risk to reward type of trade. R/R must be applied throughout the course of a trade.

Scaling in/out Trading Strategies

Trading in multiple lots will help to implement your trading strategies in flexible ways. The following strategies would be helpful depending on market conditions.

Scaling In: When a trader wishes to enter into a trade slightly early (to avoid missing out the trade), he/she may consider entering half of the position early and half of the position after getting confirmation.

Scaling Out: Scaling out strategy is to book half of profit of winning trade early and ride the trend to the maximum using another half with protective stop.

Pyramiding: It is an aggressive strategy to be adopted when a trader has entered into a trend early. He may double the position in the winning trade after getting more confirmation signals.

Let your profits run

This is the key principle which is ignored by many people. The differentiating psychological trait winning traders have is that they let their profitable positions run. The easiest thing to do is to take a profit. It provides instant satisfaction. Here again, profitable traders turn normal human psychology upside down. While most use the human emotion of fear in this instance that the profit will disappear and take the gains, winning traders have a plan with profit targets and trailing stop losses. They don’t allow the fear of losing the profit force them to book the trade. Most of the traders who make money on a consistent and long-term basis make the majority of their profits in just a few trades a month. They allow their profits to run. These huge profits cover all the small losses and pay for their hard work and discipline.

With winning psychology and money management skills, traders need a methodology to provide trading rules & signals for their trading business. Let us discuss about trading systems, the next pillar of successful trading, in next section.

Sound Trading System

Acceptable trading system should win more than it loses in the long run. It can be based on fundamental studies, technical analysis, behavioural analysis, statistical system or combinations of these. A complete trading system should provide the followings at minimum;

(i) Setup conditions

(ii) Trade entry

(iii) Stop loss exit

(iv) Profit taking exit and/or protective stop

The main criteria to be considered in selecting/evaluating trading systems are:

Personality, Trading Style and Risk Appetite

‘Know Thyself’ is the wisdom to be followed while choosing/evaluating a trading system for your trading business. You must understand your psychology and trading style first before starting to search for trading system. There are many types of traders who make money in markets consistently but their trading styles and methods are entirely different. Swing trading may suit for some people while momentum for others. Few cannot handle the stresses of day trading or short term trading but they may be comfortable with multiday trades. If you are not good in emotional management, you may go for mechanical systems which eliminate emotional decision making. If you have the mental toughness to maintain objectivity and discipline, rule based discretionary systems are likely to suit you. Risk appetite is also varies from person to person. There are varieties of trading systems which are designed for different risk profiles (low risk, medium risk and high risk). It is important to select a trading system that matches one’s psychology, trading style and risk appetite.

Win/Loss Ratio

It is the ratio of number of winning trades and losing trades. It is better if the ratio is higher than 50%. But some trading systems make good money even with win/loss ratio of 30%. They make big gains while they win. Also, think about your psychology while selecting this type of systems with lower win/loss ratio. Many people cannot stomach consecutive losing trades and follow them.

Pay off Ratio

The average profit per trade is an important yardstick. A good system should generate more profits than losses. A sound trading system should be built on key money management concept ‘cut losses short and let profits run’. The systems which are designed to generate high probability and low risk trade signals, used to deliver superior results.

Trading opportunities

The number of trades, the system generates per month/ year is also important. Full time traders cannot support their business with a system produces 3 to 5 trades per year unless their trading capital is big. They need a system that produces frequent signals.

Size of Trading Capital

The size of trading capital is also one of the key aspects in choosing the trading system. Some trading system cannot support small trading capital while bigger trading capital may need diversified trading systems.

Market Type and Major Macro Trends

Traders should pay attention to the type of markets in which they plan to trade. Each type of markets like equities, futures, commodities, Bond & FX, has certain characteristics. They must check whether the system suit the type of market. Also, major macro trends are also to be taken into consideration. ‘Buy and Hold’ mantra worked well 1980-2000 equity bull markets. The systems based on the theme also produced good results but they failed when the major trend changed in 2000. Another example is the failure of hedge fund, LTCM (Long Term Capital Management). Their successful trading strategies had started losing when Equity-Bond markets interrelationship changed due to 1997 Asian Financial Crisis. They finally had to be bailed out after 1998 Russian Financial Crisis. When tide changes, some of the trading systems will start failing. So, it is worth considering major macro trends while evaluating and selecting different trading systems.

Limitations

Each trading system has its own benefits and draw backs. Investors and traders often search through countless systems to get a perfect system (Holy Grail) which never exists. Instead, they should focus on getting a winning trading system and study the limitations of the system. They should know when their system is likely to underperform. Some systems work well in range markets while some in trending markets. Traders should assess strength and weakness of their system while evaluating them.

Final Words on Systems

After selecting the trading system that suit one’s personality and requirements, one must back test it and practice (paper trade) it to build their confidence on the system. After gaining the confidence, you must follow it religiously with discipline. Successful traders stay with their tested systems during good times as well as bad times.

Treat Trading as a Business

If you want to make trading a full time career and become successful, you must treat it as a business. Your edge in the business needs to be sharpened. Most successful professionals in every field should have spent many years in learning and practicing their profession before attaining success. There is no short cut for trading business also. To achieve success in trading, you should be ready to spend time and effort to acquire the skills. Maintain records of every transaction you make and document all of your trading efforts in a Trading Journal and categorise your observations in all three major aspects (Psychology, Money management & System). In this way, you can easily go back and study what happened before and compare to current patterns and access your improvements in every area. You need constant training and education to continue to hone skills and expertise in psychology and money management and improve your trading system. It will assist you to sustain your success in the competitive trading field. Having winning psychology and money management techniques with a sound trading system is like having license to print money. We wish you Good Luck for your trading business.

Recommended Books for Further Reading: